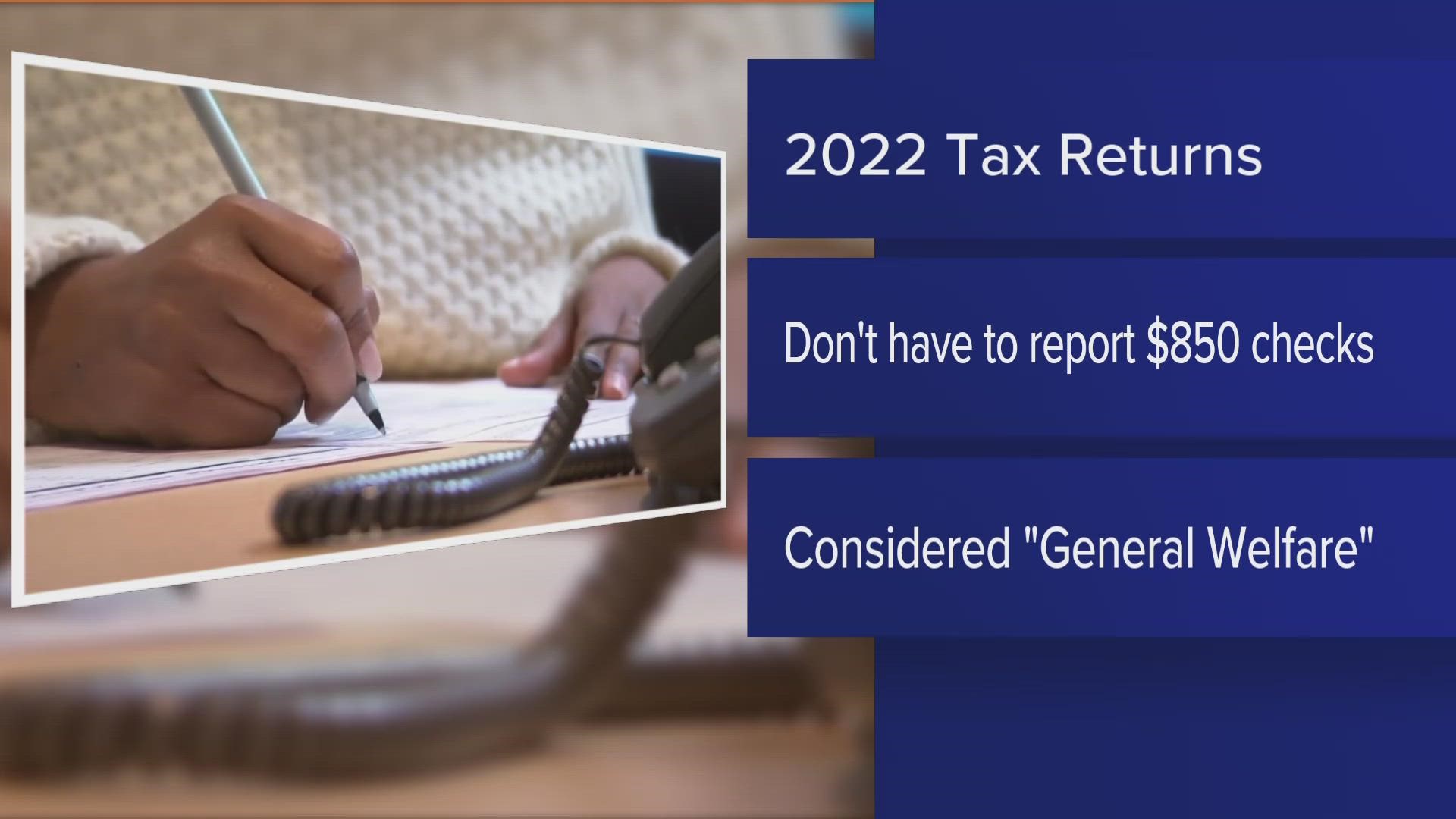

MAINE, USA — The Internal Revenue Service announced in a statement Friday that taxpayers in 21 states, including Maine, do not need to report state relief payments while filing 2022 taxes.

"During a review, the IRS determined it will not challenge the taxability of payments related to general welfare and disaster relief," the IRS said Friday.

Taxpayers in the following states do not need to report the relief payments, according to the IRS:

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Hawaii

- Idaho

- Illinois

- Indiana

- Maine

- New Jersey

- New Mexico

- New York

- Oregon

- Pennsylvania

- Rhode Island

- Alaska

"The IRS appreciates the patience of taxpayers, tax professionals, software companies, and state tax administrators as the IRS and Treasury worked to resolve this unique and complex situation," the IRS said Friday.

Before the IRS's announcement Friday, there was been a lot of uncertainty floating around this past week about whether or not Mainers should wait to file their 2022 taxes while the IRS inquires whether state relief checks are federally taxable.

The IRS issued a statement on Friday, Feb. 3, saying it was working with state tax officials to clarify whether state pandemic relief checks distributed in 2022 are subject to federal taxation.

"There are a variety of state programs that distributed these payments in 2022 and the rules surrounding them are complex," the IRS said in the statement.

On Sunday, Feb. 5, the Maine Revenue Services reportedly received an inquiry from the IRS asking for details surrounding the state's pandemic relief payments, a spokesperson with the Department of Administrative and Financial Services (DAFS) told NEWS CENTER Maine Friday.

"MRS responded the next day explaining the Pandemic Relief Program was designed with the intention of conforming with the federal tax code (specifically section 139(b)) so as not to be subject to federal taxation or included in Federal Adjusted Gross Income calculations, upon which eligibility is based," the DAFS spokesperson said.

Prior to Friday's announcement, the IRS was advising taxpayers to wait to file taxes until additional guidance was shared. The IRS was also advising against amending previously filed 2022 tax returns.

NEWS CENTER Maine reached out to the IRS on Friday morning, but the agency declined to provide any further comment on the matter.

State officials, however, have said relief checks sent out to Mainers were designed and approved to conform with the federal tax code in order not to be subject to federal taxation.

"Because of this specific design, the State does not believe the relief payments are subject to Federal tax," the DAFS spokesperson said.

"The IRS has indicated that it is in the process of reaching its own determination, and we believe that the agency should conclude too that the payments are exempt," DAFS said. "We encourage them to reach this conclusion swiftly so that Maine people, and others across the nation, may have certainty."

Mainers don't have to worry about state taxation, though. DAFS confirmed Thursday that the state of Maine has exempted the relief payments from state tax.

"If Maine people have questions about the IRS’s actions, we encourage them to consult a tax professional given that every person’s tax situation is different," the DAFS spokesperson said.