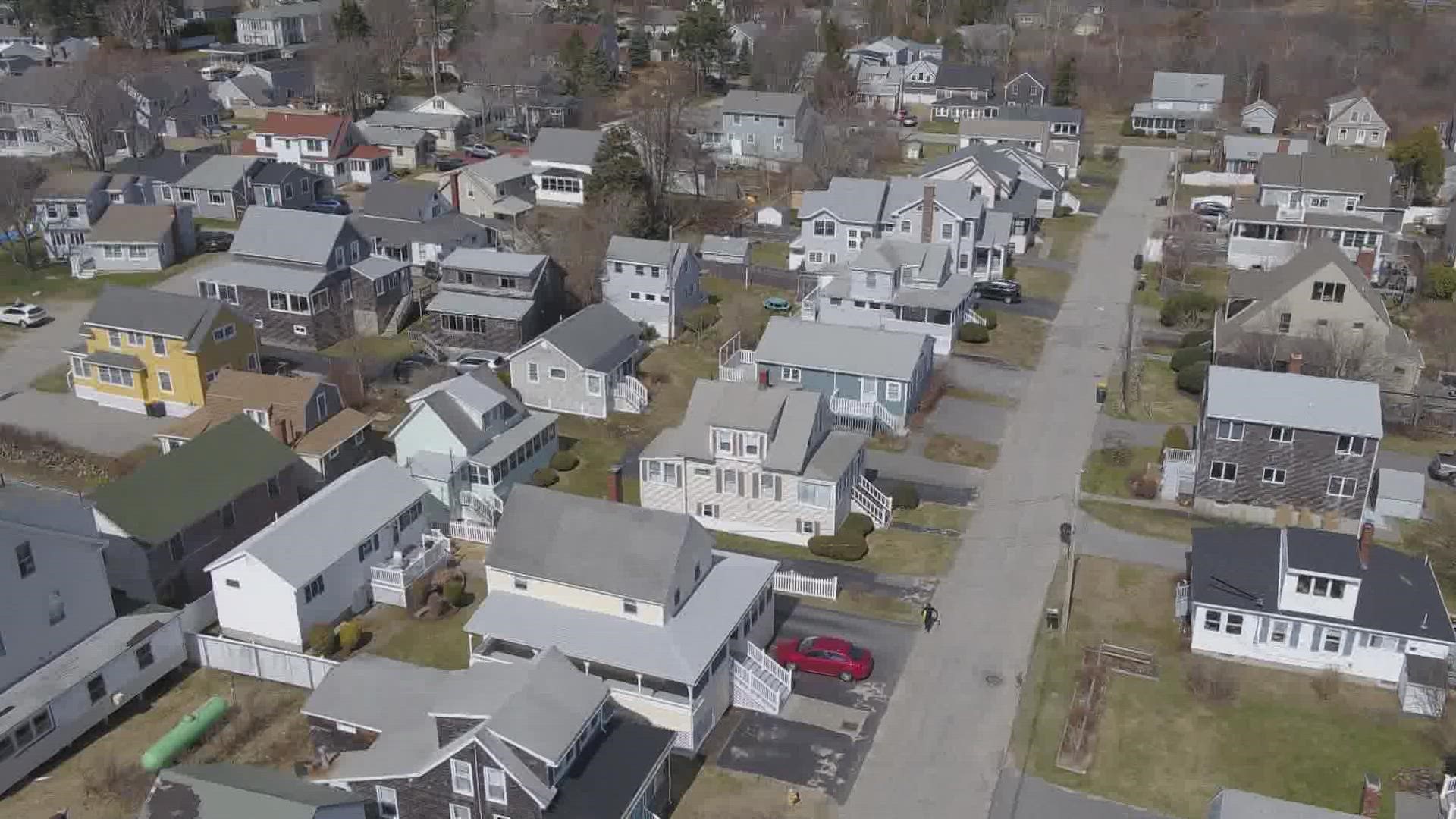

MAINE, USA — The median sales price for a home in Maine was $340,000 in August. That's nearly a 10 percent jump from last year, when that price was $310,000.

Not only are housing prices increasing, so are interest rates. According to the Maine Association of Realtors, interest rates are nearly double what they were this time last year.

"It's a competitive market we've never seen competitive quite like this ... multiple offer situations escalation clauses, people choosing not to do inspections," Madeline Hill, president of the Maine Association of Realtors, said.

She added that while still a competitive market, things are shifting.

With mortgage rates around 7 percent, buyers may be thinking twice before purchasing a home.

"People are having to adjust their target price point," Hill said.

So why are interest rates rising? John Rose from Acadia Lending said inflation is a big reason for it.

"The feds have been aggressively pushing up interest rates to slow the economy and hopefully lower inflation," Rose said. "We're recommending that all home buyers or potential home buyers, they reach out to their lender and have them sort of re-up their pre-approval or pre-qualification to make sure they still qualify."

This means some people won't qualify for as much money as they would have with lower interest rates, so hopeful buyers may need to adjust the lens of what they're looking for.

"I think naturally we're going to see buyers being more conservative because they're getting a higher rate," Hill said.

She said we're likely going to see homebuyers take a break from searching, but added that the housing market is nowhere near crashing.