AUGUSTA, Maine — On Tuesday, the Department of Administrative and Financial Services (DAFS) announced the Maine Revenue Services will extend the deadline to file Maine state taxes in eight counties impacted by the severe January storms — matching the recent Internal Revenue Service (IRS) federal tax extension deadline for Maine taxpayers until July 15, 2024.

"On April 4, 2024, the IRS announced federal tax relief for individuals and businesses in certain Maine counties affected by severe storms and flooding that began on January 9, 2024 and designated by the Federal Emergency Management Agency (FEMA) in Cumberland, Hancock, Knox, Lincoln, Sagadahoc, Waldo, Washington, and York counties, postponing various tax filing and payment deadlines to July 15, 2024," according to a release from the Maine Department of Administrative & Financial Services.

This extension is separate from a previous IRS and Maine State tax filing deadline extension through June 17, 2024, in response to 10 FEMA-designated Maine Counties, as a result of severe December storms.

The first IRS extension didn’t include Cumberland, Knox, Lincoln, Sagadahoc, and York counties. The new relief related to the January storms will include those counties and extend certain filing and payment due dates through July 15, 2024.

"For affected Maine taxpayers in these five counties, tax returns and final or estimated payments originally due on or after January 9, 2024, and before July 15, 2024, for Individual Income Tax, Corporate Income Tax, Fiduciary Income Tax (trusts and estates) and Franchise Tax are postponed to July 15, 2024," the release stated.

"Hancock, Waldo, and Washington counties did receive relief related to the December 2023 storms and already have an extension for certain filing and payments for Maine liabilities through June 17, 2024. This extended relief related to the January 2024 storms will extend those deadlines out another month to July 15, 2024. For affected Maine taxpayers in these three counties, tax returns and final or estimated payments originally due on or after December 17, 2023, and before July 15, 2024 for Individual Income Tax, Corporate Income Tax, Fiduciary Income Tax (trusts and estates) and Franchise Tax are postponed to July 15, 2024," according to the release.

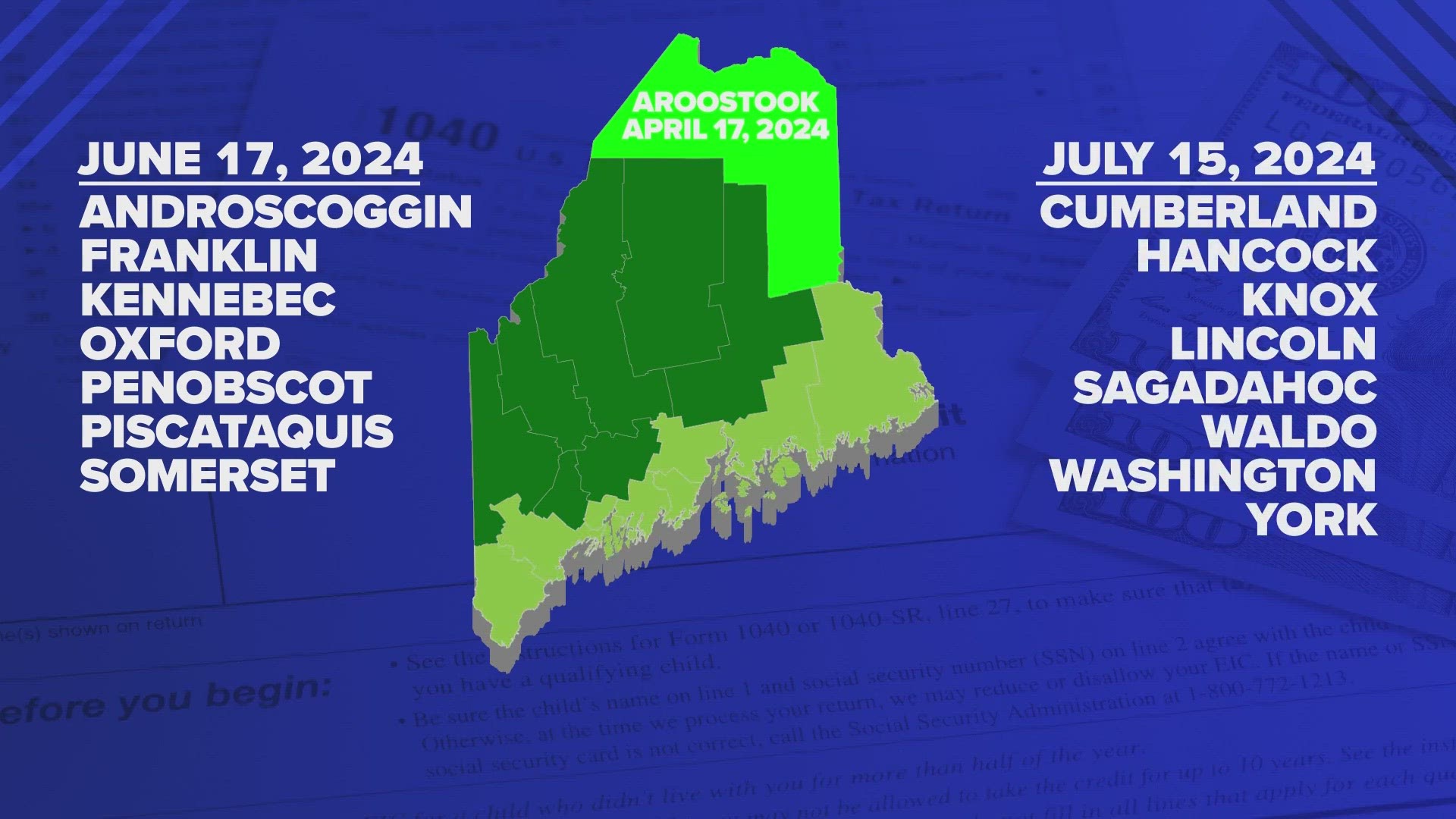

Here's when taxes are due in the following counties:

- ·April 17, 2024: Aroostook

- June 17, 2024: Androscoggin, Franklin, Kennebec, Oxford, Penobscot, Piscataquis, Somerset

- July 15, 2024: Cumberland, Hancock, Knox, Lincoln, Sagadahoc, Waldo, Washington, York

Related penalties and interest will be abated through July 15, 2024. Affected taxpayers are encouraged to file electronically, but if you choose to file paper returns you should write "MAINE FLOODING" across the top of your return, according to the release.

"Affected taxpayers are still encouraged to make payments and file if they are able and prepared to do so before July 15, 2024," the release stated.

Regardless of filing method, if any affected taxpayer receives a notice of assessment of penalties and/or interest for the Relief Period due to late returns or payments, please get in touch with MRS immediately at income.tax@maine.gov to request abatement.

Payment and filing deadlines for all other Maine tax types, including Maine sales tax and income tax withholding, remain unchanged.

Taxpayers with questions about special federal tax relief associated with federally declared disaster areas should contact the IRS at (866) 562-5227 or go to the IRS website at www.irs.gov.