WASHINGTON, D.C., USA — Sen. Susan Collins is one of two U.S. senators introducing new legislation to protect American taxpayers from fraud -- and save the country billions of dollars.

The Taxpayer Identity Protection Act would help prevent identity theft tax refund fraud among American taxpayers and seniors who typically fall victim. Sen. Collins (R-Maine) and Doug Jones (D-Ala.) are backing this legislation, which would require that the IRS expand its Identity Protection PIN program to all states around the nation over the next five years.

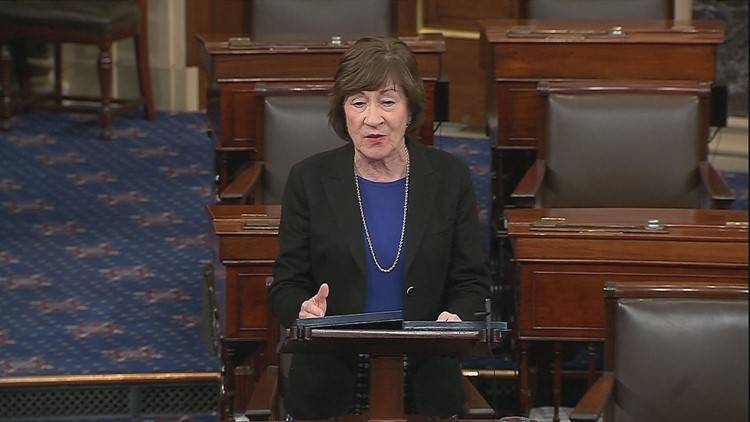

"This is a concrete action that we can take to help protect taxpayers from being ripped off by criminals and ensure that they receive the refunds to which they are entitled,” said Sen. Collins in remarks from the Senate floor Tuesday. "I encourage my colleagues to vote for the adoption of our bipartisan bill."

Sen. Jones expanded on Collins' statement.

"It’s important that the federal government make every effort to help protect taxpayers’ identities. While doing so, this program can also help save billions of dollars by preventing fraudulent tax returns."

Identity tax refund fraud happens when a scammer files a false tax return by using a stolen Social Security number and other personal information to get a tax refund from the IRS. The false payments waste taxpayer dollars, jeopardize the actual refunds for taxpayers, and threaten the integrity of the IRS.

An IP PIN is a six-digit number that can be used in addition to a Social Security number and other personal information to help prevalent false tax returns. If a tax return is sent in with a Social Security number but a wrong or missing IP PIN, the online system will reject the return until the identity of the person filing the refund is found. According to the IRS, the IP PIN program helped reject 7,376 false tax return claims in just one month during last year's tax return season.

Collins' and Jones' legislation would not require taxpayers to use an IP PIN, but it would give anyone interested in the extra layer of protection the option of enrolling. Since 2013, the IP PIN program has only been offered to people from Florida, Georgia, and Washington D.C. -- the states with the highest amount of identity theft refund fraud in the United States.

In 2017, the Federal Trade Commission received over 82,000 complaints of tax return fraud. Taxpayers whose identities have been stolen often have to wait months, or sometimes years, to get their refunds.