AUGUSTA (NEWS CENTER Maine) -- The debate over Question 1 starts with three simple words: "individuals and families."

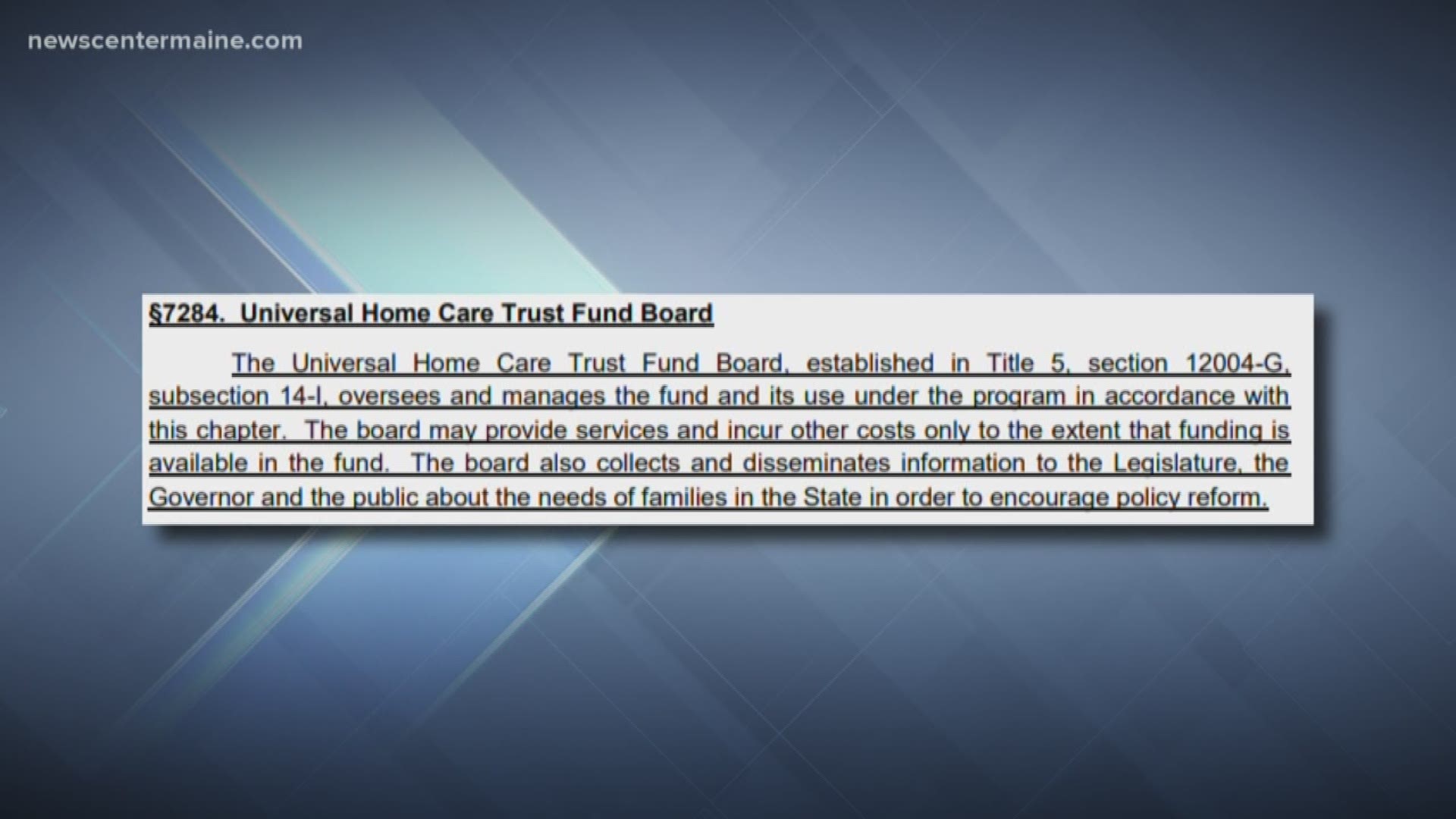

Question 1 would create a new 3.8 percent tax on individuals families with an income above $128,400 dollars to fund a universal home care program for Maine people with disabilities and senior citizens, regardless of income.

Why does this matter? A threshold of $128,400 of adjusted gross income for individuals would apply to much wealthier people than of households filing jointly, where the combined income is above that mark.

Four separate state agencies say they interpret "families" as people filing taxes jointly.

"Our office’s understanding of the Q1 legislation, as written, is that the threshold of $128,400 would apply to the adjusted gross income of married couples filing joint tax returns. That is the basis for the reference to 'individuals and families,'" wrote Kristen Muszynski, Director of Communications for the Secretary of State's office.

"Maine Revenue Services (MRS) has concluded that such joint filers would trigger the 3.8% tax. OFPR agrees with this interpretation and is using the $310,000,000 estimate that we got from MRS," wrote Marc Cyr, principal analyst with the Office of Fiscal and Program Review. "Individuals who file jointly and have combined income above $128,400 do meet the definition of individuals with Maine adjusted gross income above the threshold."

VIDEO | Exact match voting Question 1

"Other critical language in the bill – in particular, use of the term MAGI – could be interpreted in a way inconsistent with this intent. For a married couple filing a joint income tax return, MAGI is defined in law as the couple’s aggregate or combined income, so use of the term MAGI in the bill could mean that a married couple filing a joint income tax return would be subject to this tax if the couple’s MAGI exceeded the threshold, even if each individual’s wage and non-wage income fell below the threshold," the Attorney General's Office wrote.

No on 1 campaign manager Newell Augur argues that if the proposed new tax is applied to families with lower combined incomes, tens of thousands of Mainers could be paying up.

A post shared by ChrisCostaTV (@chriscostatv) on

"All we have to go on is the language. We can't step inside their head and figure out what their intent is," Augur said of the ambiguity in the ballot question's language.

"It's the intent of the legislation, the way it's written on the petitions, to make sure it only affects personal income above that amount," said Mike Tipping, with Mainers for Home Care. "We are happy to stipulate that that is true, and if there needs to be any adjustment to make sure the legislature couldn't misinterpret it, we're happy to do that too."

Mainers for Home Care held a small protest of 12 seniors outside the Maine Health Care Association in Augusta Tuesday.

"Most people would like to be able to stay in their homes, especially in rural environments. We live 20 minutes from the closest hospital," said Sidney Pew, who lives in Andover, and supports Question 1. "I think Yes on 1 is something that can help support rural Mainers staying in their homes."

What is not clear, is if earners in the same household could file individually to avoid surpassing the tax threshold.

According to the Census ACS 1-year survey, the median household income for Maine was $53,079 in 2016, the latest figures available.