Tax-free savings accounts can be a great way to set aside money for medical expenses. Whether you have a flexible spending account (FSA) or a health savings account (HSA), having pre-tax dollars stored up can make a difference when health care costs show up down the line.

These accounts are not only helpful, they’re also becoming increasingly common.

More than 20 million people had an HSA or a similar plan in 2016, up from 4 million in 2006, according to research by America’s Health Insurance Plans.

Additionally, 87 percent of all employers with 500 employees or more offered an FSA, although only 21 percent of employees took advantage used the plans, according to data from a 2016 National Survey of Employer Sponsored Health Plans by Mercer, a global consultant in talent, health, retirement and investments.

There are risks associated with these kinds of accounts. Savings above $500 stored in an FSA cannot be carried over year to year, meaning you must spend the money by the end of the year or it goes away. Meanwhile, even though money in an HSA can be carried over, there are steps you can take to ensure you’re getting the most out of your account before year end.

Consumers have a number of options to manage their FSA and HSA money.

What’s the difference between an FSA and an HSA?

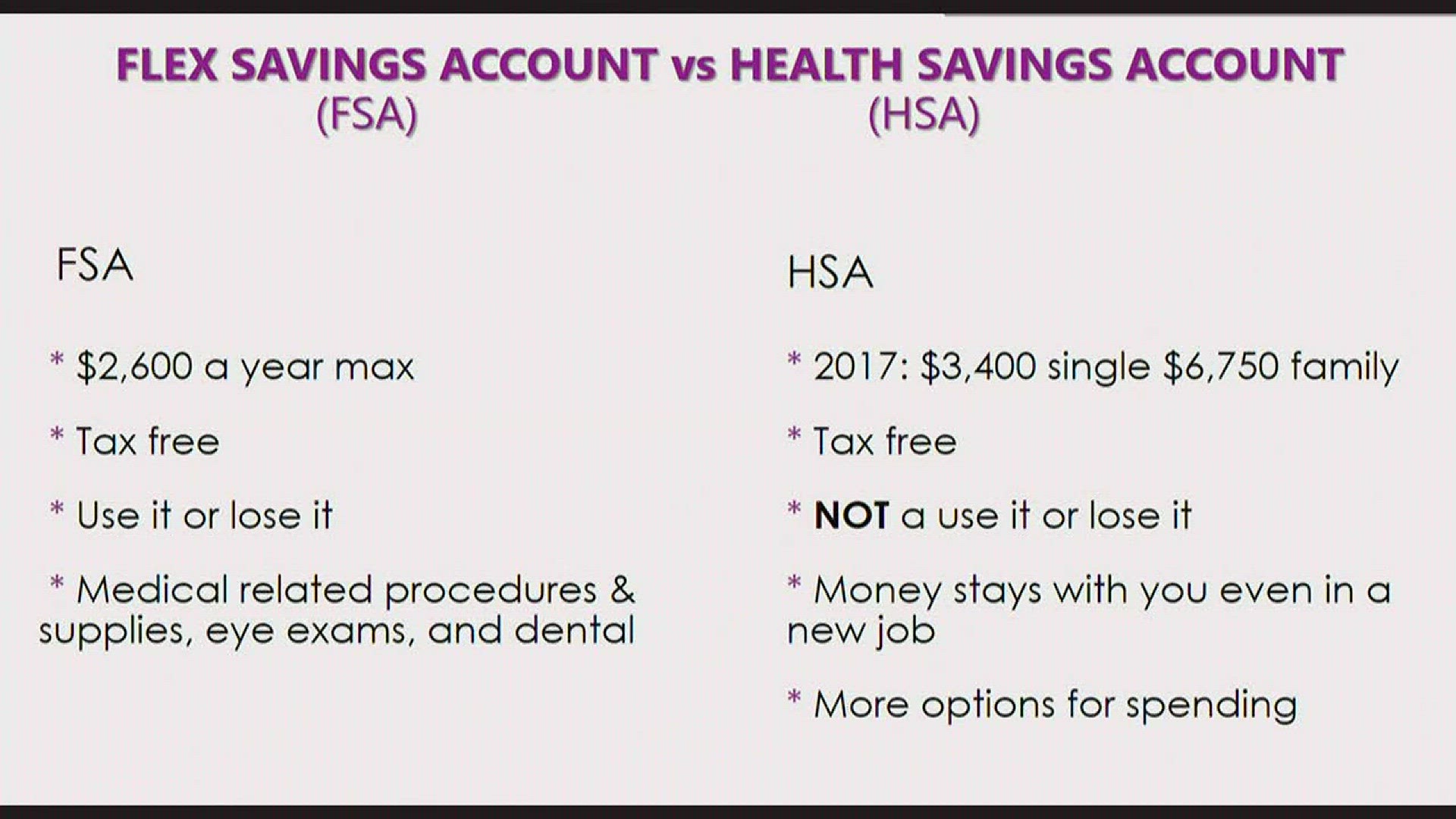

The first step to dealing with an FSA or HSA is knowing how the two vary. Both accounts have rules and features that can affect the way you approach your planning and health care spending.

FSAs are offered by companies as a benefit to their employees. An employee in 2017 can store $2,600 annually for medical expenses in an FSA. In 2018, the amount will increase to $2,650.

There are a few exceptions to this restriction though. In 2013, the U.S. Department of the Treasury and IRS modified its “Use-or-Lose” rule for FSA rollovers: Employees can keep up to $500 for the following year, or employers can offer an extra 2 ½ months for employees to spend their leftover money. Check with your company about which, if any, option is available.

HSAs are less widely available, as you need a high-deductible insurance plan in order to qualify for one. According to the Internal Revenue Service, these health care plans have an annual deductible of $1,350 or more for individuals and $2,700 or more for families.

There are advantages if you meet these requirements.

- HSAs have a higher contribution limit—up to $3,450 per year for individuals—than an FSA.

- The plans are managed by the consumer, meaning, unlike with an FSA, you can take your account with you if you change jobs.

“An HSA operates much like an individual retirement account,” says Cindy Hockenberry, director of tax research and government relations for the National Association of Tax Professionals. “It belongs to the individual and the individual can contribute as long as that person maintains a high-deductible health plan.”

How to spend leftover FSA money

Stock up on products — from sunblock to prescriptions: Most people use leftover HSA funds to purchase items they will need in the coming year, says Hockenberry, who is based in Appleton, Wis.. These items can include prescription medications, birth control, pain medicine, and most other over-the-counter pharmaceutical supplies (excluding over-the-counter medicine and drugs). FSA money can also be spent on other items like sunblock, condoms, and contact lens solution.

Go to FSAstore.com if you’re unsure what your FSA covers. The website also offers items that can be bought with funds from the account. and has a comprehensive list of non-prescription supplies you can buy with your funds The list includes potentially surprising items such as sunscreen, first-aid kits, reading glasses, and athletic braces.

Medical treatments: FSA funds can be used for medical and dental copays, so if you know you’ll need a checkup, you could save money by scheduling it before the end of the year.

You also can use the account for less conventional treatments, such as acupuncture or Lasik surgery. WageWorks, a consumer benefits information website, also includes alcoholism treatment, allergy treatment and medications, and smoking cessation programs on its full list of FSA-eligible expenses.

Avoid FSA overages next year: Spending FSA funds last-minute can certainly pay off, but wisely managing your money in advance can help you avoid having leftover money. You have to know what your medical expenses are going to be, Hockenberry says.

“You can’t plan for accidents or other mishaps, so all you can realistically do is determine your contribution level based on known expenses,” she says.

Looking back at past years can help determine an estimated amount. Take those costs and add any expenses you know you’ll have in the current year can help determine your annual costs.

Sylvia Francis, a benefits specialist and member of the Society for Human Resource Management, the world’s largest human resources professional organization, recommends that people ask themselves a few key questions at the beginning of the year. Those include:

- Copay costs

- Dental expenses

- Planned surgeries or procedures

“Only put the money you think you will be spending on allowed expenses into an FSA,” says Francis, who works as the Total Rewards Manager for the Regional Transportation District in Denver. “Don’t just randomly pick a number, or you risk losing the balance.”

What to do with your HSA money

HSAs typically have a savings-first mentality.

“There is no downside to having a large balance in your HSA,” Francis says, since the money is always yours and does not get returned to an employer if left unused.

Your employer also might contribute to your HSA each year, giving an extra incentive to saving the funds for as long as possible. According to a study from the Employee Benefit Research Institute, among people enrolled in consumer-driven health plans, 78% of employers offered HSA contribution plans in 2016.

Allowing HSA funds to grow for years could make a difference when emergency expenses appear and in retirement when you need to pay for costs not covered by Medicare. HSA Search offers a list of banks that offer HSA accounts along with the fees associated with each plan.

“I encourage folks to max out their HSA and use it as another retirement savings tool,” Francis says. “Medical expenses in retirement are generally high, and your HSA money can be used to pay for out of pocket expenses that Medicare, Medigap, and senior advantage plans do not cover.”

MagnifyMoney is a price comparison and financial education website, founded by former bankers who use their knowledge of how the system works to help you save money.